Global market continues to show divergence since 2020. Against the backdrop of such uncertain market environment, investors have stepped up their search for low risk products with attractive returns

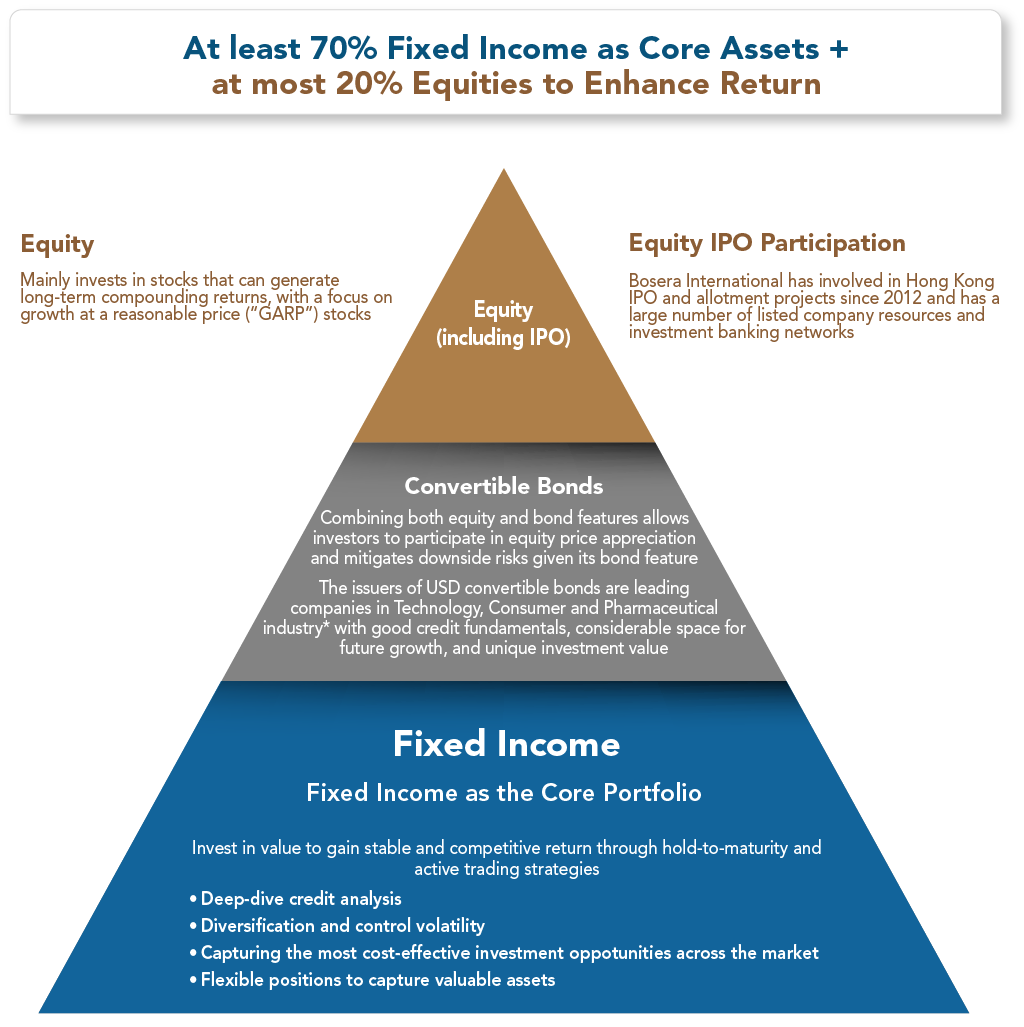

“Fixed Income PLUS” is an asset allocation concept. Our product primarily invests in Greater China fixed income securities traded both onshore and offshore to build a solid foundation in delivering high risk-adjusted returns being an expert in China assets and focusing on downside protection. The “+” part invests in high-quality growth assets to increase returns after the income “cushion” has been accumulated. Both objectives of the Fund, to capture growth opportunities while mitigating downside risks effectively, complement each other.

China has effectively controlled the spread of the epidemic, and its economy was the first to recover in the world. For year 2021, China’s Gross Domestic Product (“GDP”) grew by 8.1% year-on-year*, and its economic growth ranks top among the world’s major economies.

Since 2022, China has determined to prioritize “stabilize growth” and to carry out structural reforms and upgrades. A series of fiscal, financial, investment and other “growth and economic stabilization” measures were implemented, equipping market participants with strong support, amid the sluggish recovery of global economy. China’s economy continued to recover with better than expected economic data. In Q1 2022, China’s GDP grew by 4.8% year-on-year*, demonstrating strong resilience.

Global market volatility has increased under the current rate hike cycle. Bosera International’s “Fixed Income PLUS” strategy allocates Greater China assets across markets, identifying the most cost-effective investment targets.

As illustrated in the chart, the US 2-year Treasury bond yield is about 3.45% currently, while the Chinese 2-year Treasury bond yield is about 2.10%. Bosera International’s “fixed income PLUS” strategy seeks attractive returns by allocating to investment-grade dollar bonds with high credit qualifications and short durations.

After the substantial correction of the global stock market this year, the P/E of China’s stock market fell even more. At present, the P/E of A-shares (CSI300) and the Hong Kong stock market (Hang Seng Index) is about 11.78 times and 9.39 times respectively, lower than the 44% and 15% percentile in the past 10 years, respectively.