Bosera Investor Education | Merrill Lynch Investment Clock: a Prerequisite of Asset Allocation (20220826)

Author: Bosera Date: 26/08/2022

“Utilization of time is an advanced rule.” By Friedrich Engels.

From the US to Europe, the world economy is undergoing a decrease, which enhanced people’s anxiety about inflation and geopolitical conflicts that could render the world economy into recession. According to statistics issued by the US Department of Commerce, GDP of the US fell by 0.9% at an annualized rate in the second quarter of 2022, the second consecutive quarter of contraction for the US economy. And two consecutive quarter of decrease of GDP indicates an economy has stepped into a technical recession. Simultaneously, More sectors face a gloomy outlook and record energy prices and food rises lead to lower demand, as Eurozone GDP shrinks.

As a classic theory of Asset Allocation, Merrill Lynch Investment Clock states the relationship between asset rotation and the economic cycle, which tells people to allocate their assets according to trends.

What is Merrill Lynch Investment Clock?

Before introducing Merrill Lynch Investment Clock, let’s know more about the economic cycle.

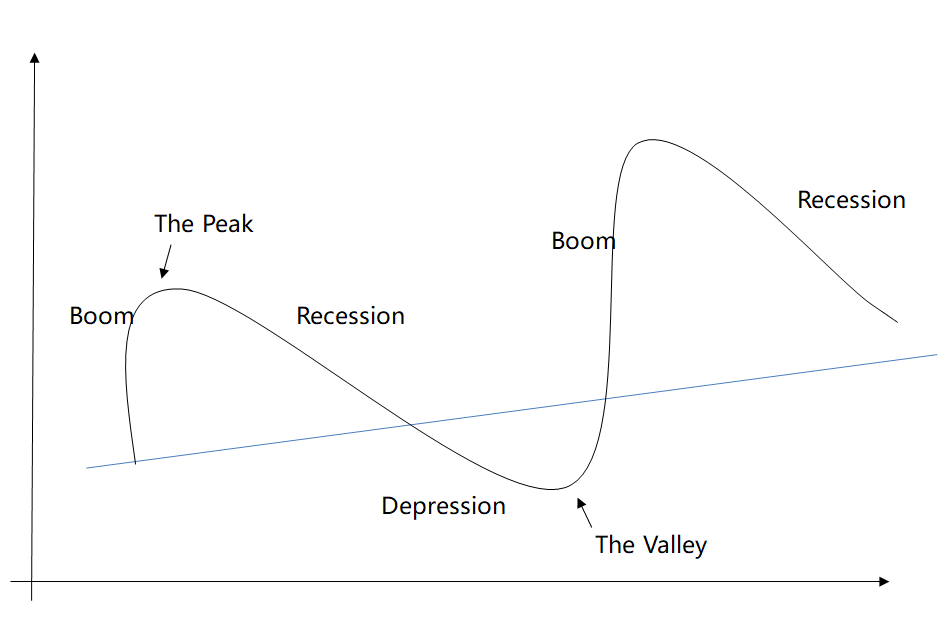

The Economic Cycle is also named as the Business Cycle or the boom cycle. The Economic Cycle an explanation of cyclical fluctuations such as economic expansions and contractions that occur repeatedly at certain intervals inside an economy. Ideally, an economy grows based on the influence of its technology, capital and labor force, however, due to multiple external and non-rational factors, the actual economic growth turns out to be a cycle of “recovery-boom-recession-depression-recovery”.

Figure 1: Economic Cycle Curve

Source: Bosera Internation

At different stages of the economic cycle, the core "contradictions" in the market are not the same, and therefore the performance of various assets also has its ups and downs. The Merrill Lynch Clock was developed by Merrill Lynch in 2004 in The Investment Clock and is based on a study of 30 years of historical data in the US from 1973 to 2004, linking asset rotation and sector strategies to the economic cycle.

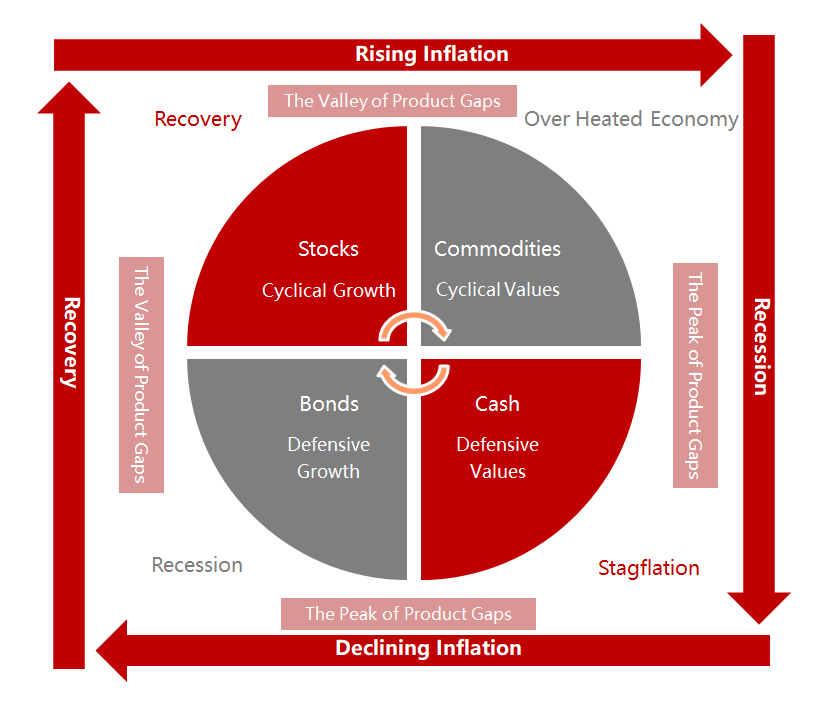

The Merrill Lynch Investment Clock divides the economic cycle into four stages: recession, recovery, overheating and stagflation, and there are four asset classes: bonds, equities, commodities and cash. It demonstrates that in a complete economic cycle, as the economy gradually cycles from recession to recovery, overheating and stagflation, the bonds, equities, commodities and cash lead among the general assets in return.

Figure 2: Merrill Lynch Investment Clock

Sources: Merrill Lynch, Bosera International

The underlying logic of Merrill Lynch Clock at a macro level

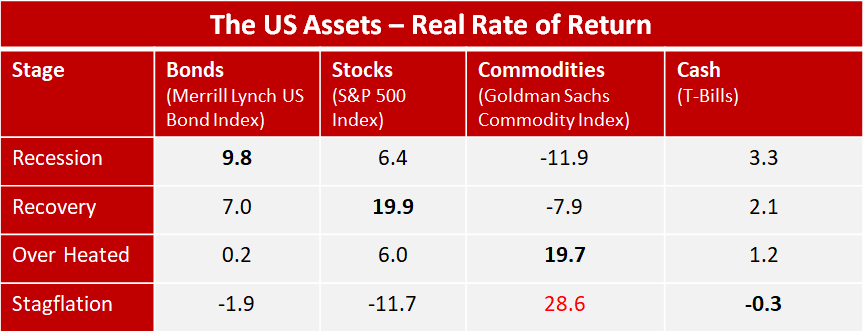

Based on 30 years of monthly data from the US, Merrill Lynch uses the movement of "GDP (Gross Domestic Product)" and "CPI (Consumer Price Index)" as two indicators of the economic cycle to calculate the average asset returns and industrial asset returns for each asset in phases of recession, recovery, overheating and stagflation, thereby recommending bonds, stocks, commodities and cash in the corresponding phase.

Conclusions are as following:

Source: Merrill Lynch, April 1973- July 2004

Recession (Low GDP + Low CPI): Bonds are the best choice.

During the recession, the economy lacks fuels and at this time, inflation falls because of the fall in commodity prices due to overcapacity. In order to boost economic growth, central banks begin to implement an loose monetary policy and interest rates are lowered. This is the period when bonds perform the best and commodities perform the worst.

Recovery (High GDP + Low CPI): Stocks are the best choice.

During the recovery, the loose monetary policy begins to take effect gradually and the economy shows an upward trend, while inflation will continue to move downwards as the surplus capacity generated during the recession has not yet been absorbed. At this point, cyclical production growth shows optimism and corporates’ profits improve significantly, making stocks the optimal asset at this stage.

Overheating (High GDP + High CPI): Commodities are the best choice.

When the economy enters an overheating, production growth slows down, capacity peaks and inflation rises. At this point, the central bank implements a tight monetary policy by raising interest rates in order to bring the economy down to sustainable conditions. However, the central bank's interest rate hike reduces the attractiveness of bonds. Stocks’ value is relatively strong. Commodity prices rise and outstand among other assets.

Stagflation (Low GDP + High CPI): Cash is the best choice.

When the economy enters a stagflation, production growth begins to stagnate and companies begin to raise the prices of their products in order to maintain profit levels, but unemployment remains at a high level. The downward economy and the upward inflation led to a downturn in both stocks and bonds as well as commodity markets. Although commodities had an average annual return of 28.6%, this was largely influenced by the impact of the oil crisis of the 1970s, and commodity prices excluding oil were trending downwards. Therefore, the optimal asset during this period is in the high-security cash.

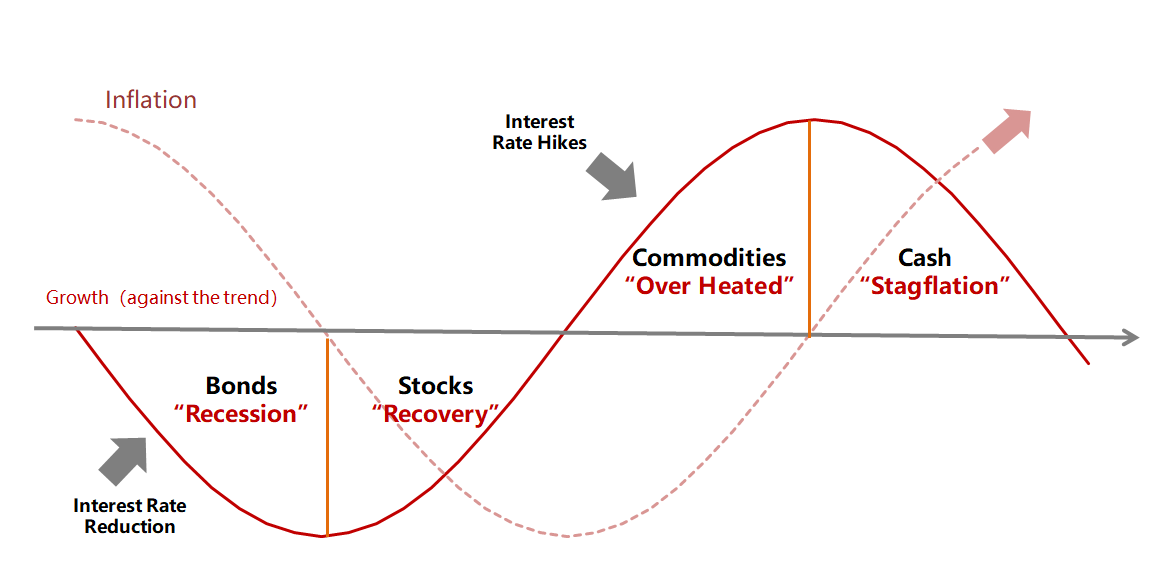

Thus, the matrix of economic growth and inflation drive changes in consumer behaviour, corporate profitability, corporate capital expenditure, monetary policy and market sentiment, ultimately making the yields of various asset perform differently over time and driving the rotation of the investment clock.

Figure 3: Theoretical Economic Cycle

Source: Merrill Lynch, Bosera International

What is a Merrill Lynch Fans?

In recent years, there has been an increasing skepticism about the Merrill Lynch clock. After the 2008 financial crisis, the US broad asset development gradually deviated from the asset rotation pattern revealed by the Merrill Lynch clock and people began to question whether the Merrill Lynch clock framework was outdated. Some also believe that the Merrill Lynch investment clock is not suitable for the Chinese investment environment.

Firstly, Merrill Lynch's investment clock theory is based on the assumption that the economy dominates finance, that the short-term economy fluctuates around the long-term economic trend, and government counter-cyclical macro-control irons out short-term economic fluctuations. However, various unforeseen events in the market, counter-cyclical policy adjustments, the effectiveness of different countries' monetary and fiscal policies and even data lags can cause economy cycle to accelerate rotation or even jump.

In addition, there are two main reasons for the bias in the effect of the Merrill Lynch clock in China: (1) There are differences in the monetary policy making framework between the US and China, the Fed's monetary policy framework is mainly based on the output gap and inflation changes, while China's monetary policy takes into account multiple objectives, including economic growth, full employment, price stability, internal and external balance, financial risk prevention, etc. (2) The performance of China's broad asset classes is not limited to economic growth and inflation, but is also influenced by the strength of policy reforms and financial regulation, etc.

Therefore, it is possible to learn from the Merrill Lynch clock, but not to follow it blindly. There is a pattern to everything in the world, and finding the pattern is the first step to think. By continuing to stand on the shoulders of the first level of thinking and having your own second level of thinking, such as awareness of risk and thinking backwards, and by reasonably adjusting your asset allocation structure in relation to your own risk tolerance, you will have a better chance of achieving excess returns in the ever-changing economic cycle.

At present, along with the persistent impact of the COVID-19 pandemic, as well as the Russian-Ukrainian conflict, developed countries to further tighten policy and other factors, the market "stagnation", "up" trend deepened, and "cold The market is "stagnant", "up" trend deepened, and the "cold" full. But the economy is depressing. Does it mean there is no opportunity to invest in the market? The answer is no. You can see that there are major asset classes that perform well in different phases of the economic cycle. At the same time, opportunities to capture cost-effective targets emerge when markets are down. By identifying important inflection points in economic cycle fluctuations and combining them with current cyclical regulatory policies, there is a better chance of capturing the trend profitably in the changing cycle.

Risk Warning

Investment involves risk. Past performance of the fund is not indicative of future performance. Investors should not make investment decisions solely on the basis of the information contained in this material, but should refer to the Explanatory Memorandum and the Key Facts Statement of the Sub-Fund for further details, including the product features and risk factors before making any investment decisions. The investment value may also be affected by exchange rates. Investors should seek professional advice. pThis information is for informational purposes only and does not constitute a solicitation or undertaking to buy or sell any investment product. Bosera Asset Management (International) Co., Limited ("Bosera International") believes that the source of data obtained is accurate, complete and appropriate when preparing this information. However, Bosera International does not guarantee the accuracy or completeness of the information contained in this material. Bosera International is not responsible for any legal responsibility arising from the use of this information. This information may contain "forward-looking" information and be not just historical. Such information may include forecasts or return estimates and possible portfolio composition. This material does not constitute an estimate of future events, research or investment advice, nor should it be considered a recommendation to buy, sell any security or adopt any investment strategy. The opinions expressed in this material only reflect the judgment of Bosera International on the date of compiling the material, and may be changed at any time due to subsequent changes in circumstances without prior notice. pThis information has not been reviewed by the Securities and Futures Commission of Hong Kong. Publisher: Bosera International. Without the consent of Bosera International, you may not copy, distribute or reproduce any material or any part of this document.